Wisdom for Mankind

Transforming Lottery Funds into Pension Schemes: Reimagining Retirement Savings in Thailand

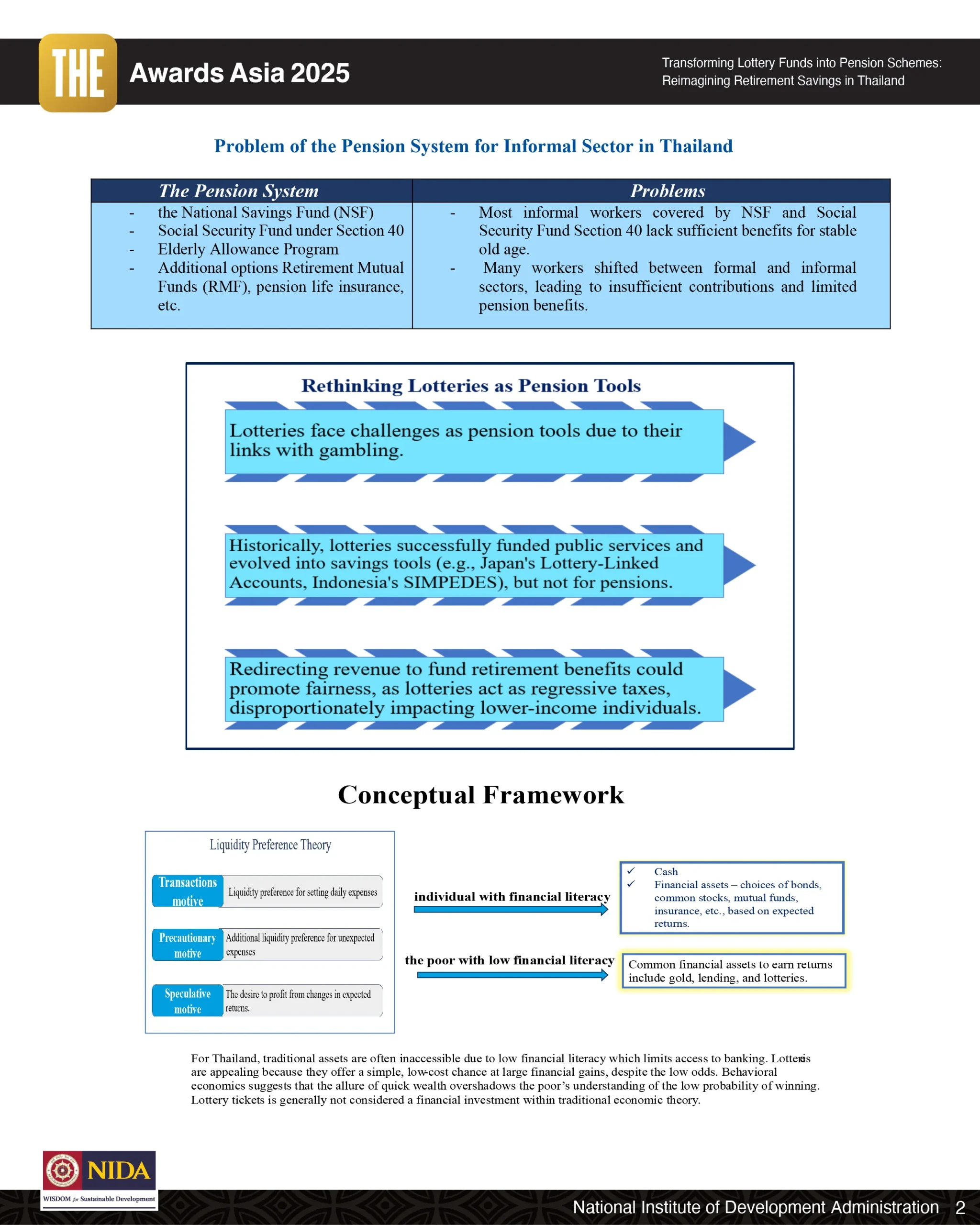

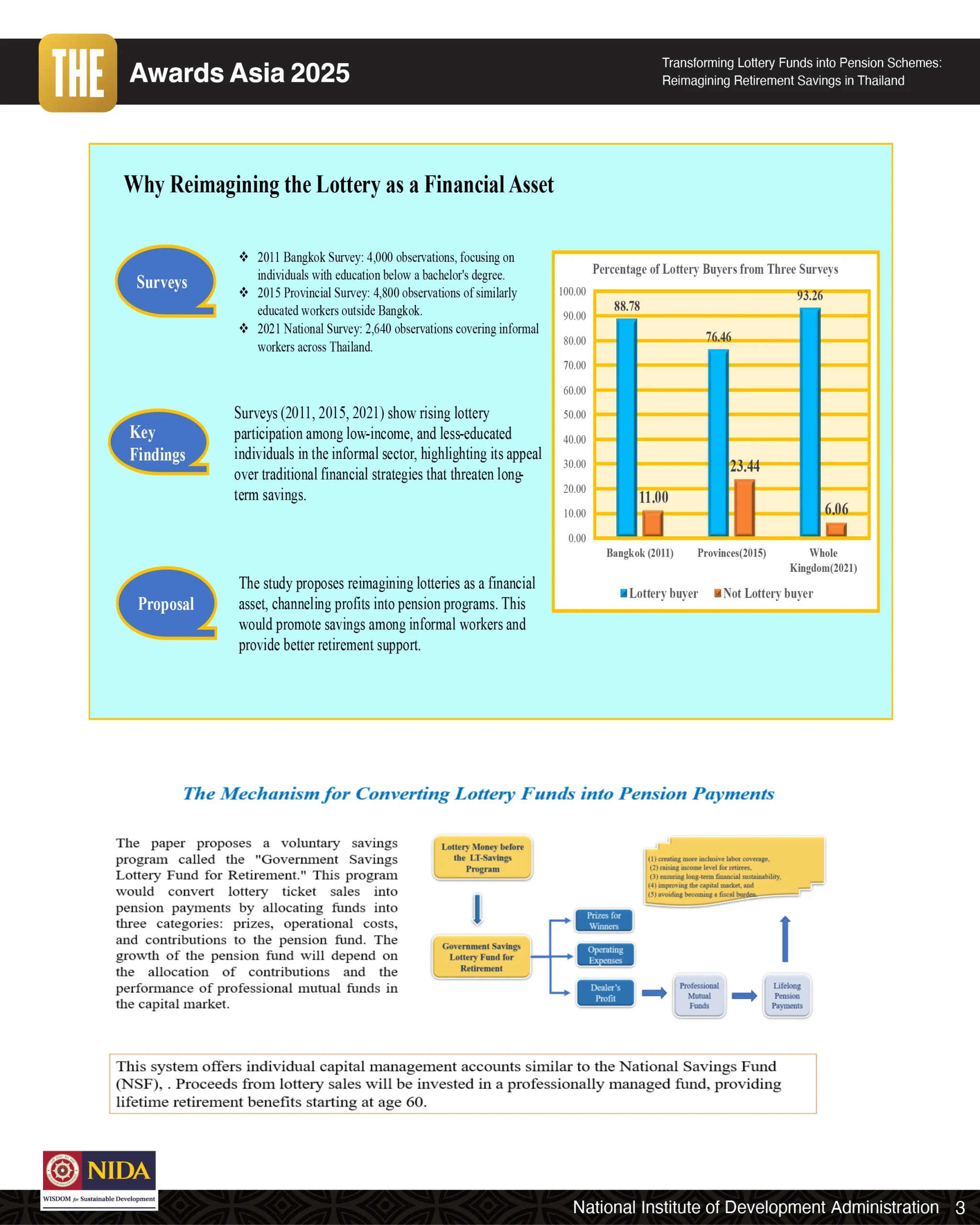

Low-income informal workers worldwide often lack access to social security systems. In Thailand, only 27.45% of informal workers currently participate in voluntary pension schemes, leaving 20.34 million without coverage. To safeguard their future financial security, this research proposes an innovative savings tool that redirects lottery spending into retirement savings. This initiative arises from the observation that many low-income individuals regularly purchase lotteries, viewing them as their only hopeful investment despite the risks to their retirement savings. The proposed mechanism allocates a portion of lottery sales to pension funds, with built-in indicators to ensure participants’ continuous engagement in the long-term savings program until retirement. Following multiple attempts to propose this framework since 2001, the Thai Cabinet finally approved the Retirement Lottery project in 2024, with its launch planned for 2025. This initiative, aimed at boosting savings for informal workers and could be adapted by other countries facing similar pension challenges.

Assoc. Prof. Pornpen Vora-Sittha (PhD.)

News & Events

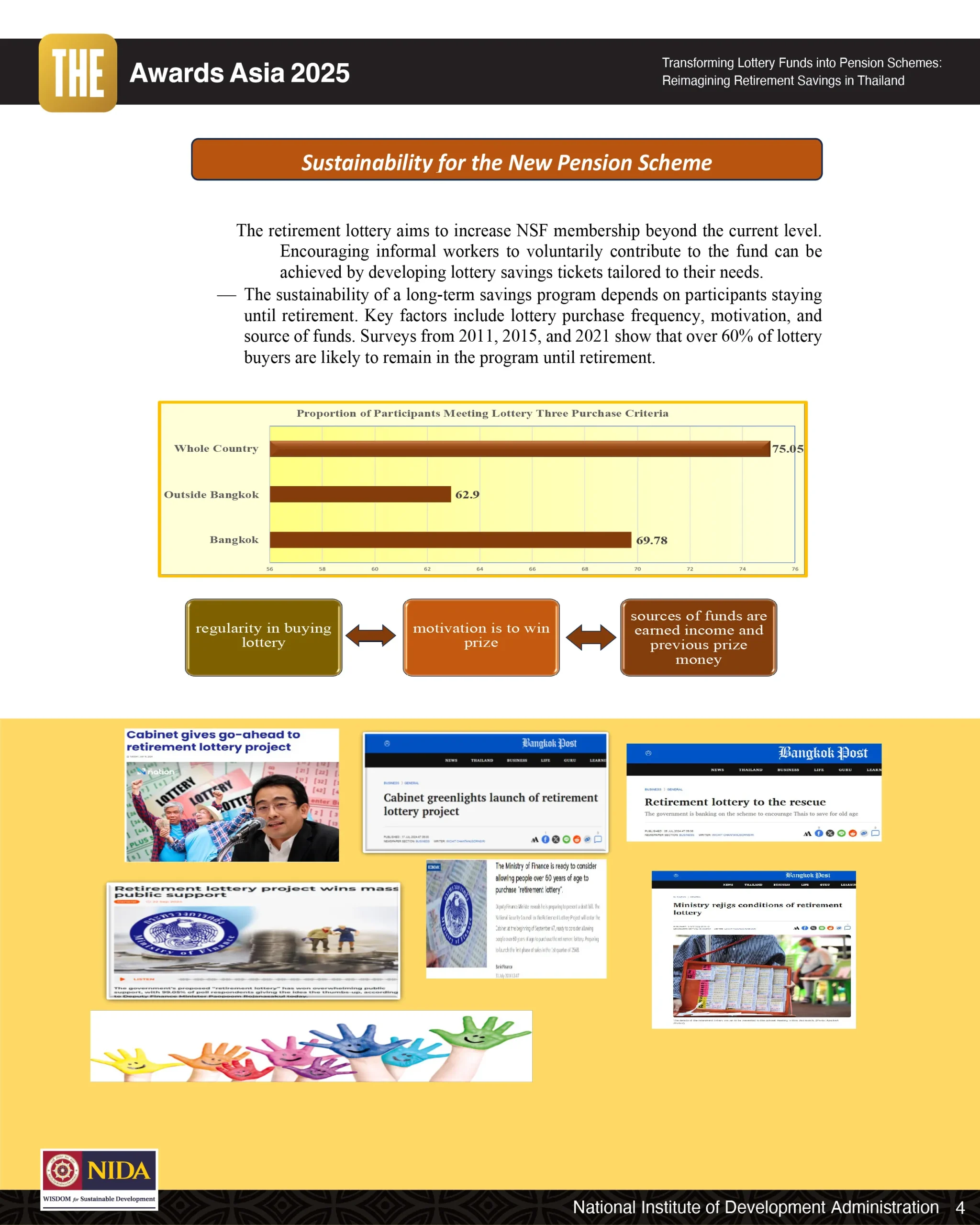

Cabinet greenlights launch of retirement lottery project

Cabinet greenlights launch of retirement lottery project

The cabinet has approved a savings innovation for low-income individuals, known as the retirement lottery, which offers attractive prizes.

Retirement lottery to the rescue

It is alarming that nearly half of the country’s workforce, comprising 37.5 million people, lacks a retirement savings plan.

Even more shocking is that Thailand is now an ageing society, while the welfare benefits paid by the government to elderly individuals — aged 60 and above — range from 600 to 1,000 baht per person per month, depending on their age, which is not sufficient to cover their living expenses.

Public Backs “Retirement Lottery” savings bonds

The Ministry of Finance has announced the outcomes of a public consultation on the proposed revisions to the National Savings Fund Act, held from August 16 to 30. The feedback focused on potential amendments, such as the launch of retirement savings bonds, also termed as a “Retirement Lottery.”